"Ask Gib": A Summary of my Product Strategy Frameworks

If you’re working at a startup or a well-established company, in a B2B, enterprise or consumer-focused company, these six product strategy frameworks will help you to define your product strategy.

Foreword

I answer a few monthly questions, drawing from my experience as VP of Product at The Learning Company, Mattel, Netflix, and Chegg.

To ask and upvote questions, click here.

To see all 65 of my essays, click here.

Sign up for my 2 x 2.5-hour Product Strategy Workshop on Maven by clicking here. (I included a 10% “Ask Gib” discount with the link.)

Five years ago, I wrote a 12-part series on Medium entitled “How to Define Your Product Strategy.” The series now has 30,000 likes. My goal was to demystify product strategy and help develop a shared language that would make it easier for product leaders to collaborate and establish a “SWAG” — a stupid wild-ass guess—that they could later develop into a scientific wild-ass guess. Rather than copying and pasting my product strategy essays to Substack, I built an executive summary of the series. I am sharing it with you today, along with links to an essay that describes the model in further detail.

My Maven Product Strategy Workshop

I teach a 2 x 2.5-hour course on Maven every 2-3 months. We dive into each model and explore many examples and cases from Consumer, B2B, and Enterprise companies— from startups to behemoths. There’s plenty of time for Q&A, and I simulate a modern-day Netflix Quarterly Product Strategy Meeting at the end of the session. I also provide pre-formatted Google Slides that make building a product strategy easier.

The next two workshops are:

April 1 and 3 (both sessions are 9-11:30 am PT)

October 28 and 30 (both sessions are 9-11:30 am PT)

The first three cohorts cost $250, but on Thursday, March 6, at midnight, I will increase the price to $350. Why? I expanded the course from three to five hours. I also improved the quality of the experience through iteration, as measured by a Net Promoter Score of 70, which is considered world-class. You can read student reviews and learn more about the course here.

EXECUTIVE SUMMARY OF MY PRODUCT STRATEGY FRAMEWORKS

I’ll begin with….

HOW THE SIX TOOLS FIT TOGETHER

The frameworks help to answer four high-level questions:

1) In the long term, what are you building? Two models help answer this question:

Positioning (What it is, benefits, personality, brand promise)

GLEE product vision (Get big, Lead, Expand, Expand)

2) What are the company’s high-level priorities?

The GEM model requires companies to force-rank Growth, Engagement, and Monetization and assign a proxy metric for each factor.

3) What are your hypotheses for how to deliver the product in the long term? These two models set the foundation for your product strategy:

DHM. This model helps you formulate product strategies to delight customers in hard-to-copy, margin-enhancing ways.

SMT. This framework aligns Strategies, Metrics, and Tactics (projects) to measure progress.

4) How does your work (the projects/tactics) fit together over time?

Roadmaps are an output of your product strategy and help bring it to life. A product strategy includes a high-level roadmap for the overall company and a more detailed roadmap for each swimlane.

5) Define an overall product strategy + a strategy for each swimlane.

The high-level product strategy for the company includes:

Positioning and brand promise

Product vision (GLEE)

GEM prioritization

SMT(Strategy/Metrics/Tactics for the overall product), plus

An executive summary of the company’s roadmap, organized by swimlane.

Individual product leaders define the SMT for their swimlane, along with a roadmap, which is more detailed than what is presented in the overall company product strategy.

Developing a product strategy is an iterative, top-down/bottoms-up process. The work of the head of product and the folks who work for them eventually meet in the middle.

I encourage individual product leaders to quickly create a SWAG for the company's overall product strategy. Over time, the strategy evolves from a stupid wild-ass guess to a scientific wild-ass guess.

Below is a summary of each product strategy model plus links to detailed essays.

1. POSITIONING AND BRANDING MODELS (essay)

These two frameworks define your positioning and brand promise. To apply the first model, ask yourself three questions:

1.) How do you describe your product in simple, 6th-grade language?

2.) How does the product or service benefit customers?

3.) How do you define the product’s personality? If you met this product at a gathering, how would you describe it? (The question behind the question: How do you want your product to relate to customers?)

Here’s the model applied to Netflix:

What is Netflix? A monthly subscription for TV shows and movies

How does it benefit customers? It's fast, easy, entertaining, and a great value

What is its personality? Straightforward, friendly

To define your "brand promise," summarize your product and its benefits as briefly as possible. This is the headline for your positioning. Your brand promise is the product you hope to build—it's okay to be a little aspirational.

Here’s a Netflix example from the early years:

Brand promise:

"Movie Enjoyment Made Easy."

Positioning:

Netflix is a TV and movie subscription service that delivers fast, easy entertainment in a friendly, straightforward way.

2. THE GLEE MODEL (essay)

How to define a long-term product vision that provides a sense of where the company is headed along with its potential. Breaking progress down into 3-5 year steps makes it feel more feasible.

Here's an example of the GLEE model applied to Netflix. Note that the first letters spell “GLEE.”

Netflix Product Vision

Get big on DVDs

Lead streaming

Expand international

Expand into games

Exercise

To complete the GLEE exercise for your product and company, ask yourself three questions:

1) What initial product or service enables the company and product to “Get Big” over the first three to five years? What initial product will be 10 times better than other choices? Are there trends the product can ride, as Netflix rode the wave of DVD players and e-commerce? What are the trends for your product or company?

2) As you get big, what is the next phase that the product will “Lead?” For Netflix, it was internet video and the opportunity to “Lead streaming.”

3) Once your product establishes a leadership position, how might it “Expand” further? Given the hard-to-copy brand, network effects, economies of scale, and unique technologies your product will establish, what is the next wave of growth? For Netflix, it was an international expansion, with original content produced worldwide via the ability to translate TV shows and movies into forty languages.

4) Expansion continues forever. Even as the company matures, product leaders need a compelling answer to the question, “What’s next?” Today, Netflix is experimenting with games and live TV as potential step-function innovations.

Complete the GLEE model for your product and company. Think long-term (10-20 years) and dare to be aspirational. It’s ok to think of these stages as hypotheses— most companies rarely get it right— but the model provides a compelling vision of your product's potential size and how it might someday “dent the universe.”

Take a SWAG at the GLEE model for your overall company and product.

Product Vision

1. Get Big on _______________

2. Lead ____________________

3. Expand __________________

3. THE GEM MODEL (essay)

The GEM model helps companies identify their high-level priorities, which inform the product teams’ overall priorities.

The three factors are:

1. Growth: Year-over-year customer growth rate.

2. Engagement is a proxy for product quality; it measures a product's overall goodness.

3. Monetization: A measurement of the company’s economic efficiency— the ability to deliver revenues and profit in the long term.

Determine how you will force-rank your company’s growth, engagement, and monetization, then identify the metric you will use to measure each.

Exercise

Define a proxy metric for each factor, then force rank them. Here’s an example for Netflix today:

Growth: 10% YOY customer growth

Engagement: Monthly retention (about 2% of Netflix members quit each month)

Monetization: $15 Average revenue per member

Today, I would prioritize the three factors for Netflix as follows:

Growth

Monetization

Engagement

There’s no correct answer for ranking these factors. My thinking: About two years ago, Netflix's growth stopped due to theaters reopening after COVID subsided and consumers spent more time away from their televisions. Netflix re-accelerated growth by launching low-cost ad-supported programs and experimenting with live TV. I put engagement third because 98% monthly retention is excellent, and there are likely diminishing rates of return.

The key is for an executive team to align on GEM prioritization and communicate the ranking across the entire organization.

4. THE DHM MODEL (essay)

This model encourages product leaders to consider how to Delight customers in Hard-to-copy, Margin-enhancing ways. Margin is a fancy way to describe profit (or revenue for early-stage companies). Below, I go in depth on the DHM model, how to go beyond a list of potential features to develop product strategies, and a bottoms-up approach.

Delight

For startups, the goal is to build a tenfold better product than other choices. Customers who rave about the product generate word of mouth, enabling startups to accelerate growth. In the early days of DVD players, Netflix offered 100,000 TV shows and movies on DVD, while Blockbuster provided only 5,000 choices. A core set of customers raved about Netflix’s large DVD selection.

As the company grows, the challenge is to build a hard-to-copy advantage and to deliver a business model that provides revenue and margin.

Hard to copy attributes

What are your product's potential hard-to-copy attributes? I list eight below. (Hamilton Helmer's book 7 Powers is an excellent resource.) The goal is to set your company up so that it’s tough for other companies to compete with you because of your hard-to-copy advantage.

1) Brand

Building a trusted relationship with customers.

Netflix built its brand around the promise of "Movie enjoyment made easy." After twenty-five years, 300 million customers trust Netflix with their credit cards each month. These customers allow Netflix to try new things, such as original content, games, and live events.

2) Network effects

The value of the service to each customer is enhanced as each new customer joins the network.

Netflix built an initial network effect around "Netflix Ready Devices" (PlayStation, XBox, Wii, Roku) and Smart TVs to create a network with hardware manufacturers where Netflix members can watch movies on any screen. Eventually, they extended to all screens, including mobile devices. Today, Netflix is building a studio ecosystem, providing moviemakers with tools to help them create and digitize TV series and films. As the world's largest studio, Netflix can amortize its studio tool and technology budget across hundreds of studios worldwide.

3) Unique technology

Hard-to-build technology is often hard to copy.

Netflix's personalization technology intuits the movie tastes of nearly a billion movie-watchers worldwide, given that each member has multiple profiles. Netflix’s personalized merchandising helps members find movies they’ll love. It also allows Netflix to “right-size” their investment in content by providing precise forecasts for TV shows or movies, which lets Netflix decide how much to invest in each.

4) Economies of scale

Declining unit costs for the business as it gets larger.

Today, Netflix amortizes the cost of its original content across 300 million members. They invest nearly $20B a year in content, while companies with smaller streaming audiences, like Disney, operate at half that budget, given they have half the members.

5) Switching costs

It's difficult for a customer to switch from one product to another, giving a company a hard-to-copy advantage.

Switching costs are more prevalent in large SAAS or enterprise businesses. For example, switching from Oracle to Salesforce requires a large, time-consuming migration. Moving from Netflix to a competing service involves minor switching costs, so this hard-to-copy attribute doesn’t provide Netflix with a significant long-term advantage.

6) Counter positioning

This hard to copy attribute is rare, but it occurs when an upstart company introduces a new business model that an existing company can't replicate, often because it poses a financial threat to its core business.

Netflix counter-positioned itself against Blockbuster with a "No Late Fees" positioning. Blockbuster couldn't respond with the same offer, as most of its profits came from late fees.

7) Captured resource

Patents are a good example of this: They give companies access to materials, tools, technology, or talent that other companies can't replicate.

There's a weak argument that the early team of Reed Hastings (co-founder), Patty McCord (Talent), and Neil Hunt (product), who had all worked together at a previous startup, were a rare combination of talent that others could not access or duplicate.

8) Process power

Sustained operational excellence that, even though unprotected, is nearly impossible for other companies to replicate.

This is a rare attribute. But there's an argument that Netflix, through its continued re-encoding of movies and TV shows, has process power. They re-encode each movie and TV show in thousands of "flavors" for different formats (PC v. TV v. mobile), at various image and sound quality levels, for different bandwidth requirements, and in 40 languages, with and without lip-synching and subtitles. Even though they do this “in the open,” it’s hard for other streaming companies to replicate Netflix’s work.

Margin-enhancing

What are the potential ways your product will generate revenues or profits? Examples from Netflix:

An a la carte DVD by mail service (an early failed experiment)

An "all you can eat" monthly subscription plan

Ongoing price and plan experiments

Low-cost, ad-supported plans

Right-sizing via personalization (accurate forecasting of TV and movie demand to calculate budget)

Previously viewed (used disk) sales

Paying sub-accounts

Multi-household plans

Cost-based merchandising (inform algorithms with the cost of TV show/movie)

Exercises to form product strategies

Exercise #1: Delight. Please describe how your product delights customers today and what will make it even better in the future.

Exercise #2: Hard to copy. Using the Netflix examples above as a guide, list all the ways your product might create a hard-to-copy advantage.

Exercise #3: Margin-enhancing. List all the possible business models and price/plan experiments you will explore over the next few years.

Moving from DHM to Product Strategies (essay)

The simplest way to illustrate how product strategies evolve from the DHM exercise is to consider how various high-level hypotheses — your product strategies — might delight in hard-to-copy, margin-enhancing ways. Below, I have completed the history of various Netflix product strategies and the extent to which they delight, build hard-to-copy advantage, or deliver margin. Note that only five of Netflix’s strategies achieved these objectives, and the results for the other half were either ambiguous or failures. Even world-class product organizations get it right less than half the time.

Exercise: In thinking about your product’s potential “delighters,” hard-to-copy advantages, and business experiments, what are 4–6 high-level hypotheses you’d like to test over the next year or two? What are your strategies to improve your high-level engagement metric from the GEM exercise?

Working Bottoms-up (essay)

Exercise: If identifying your product strategies is challenging, try the bottom-up approach. Create a list of essential projects and sort the ideas into “buckets.” The names of these buckets likely articulate your high-level product strategies.

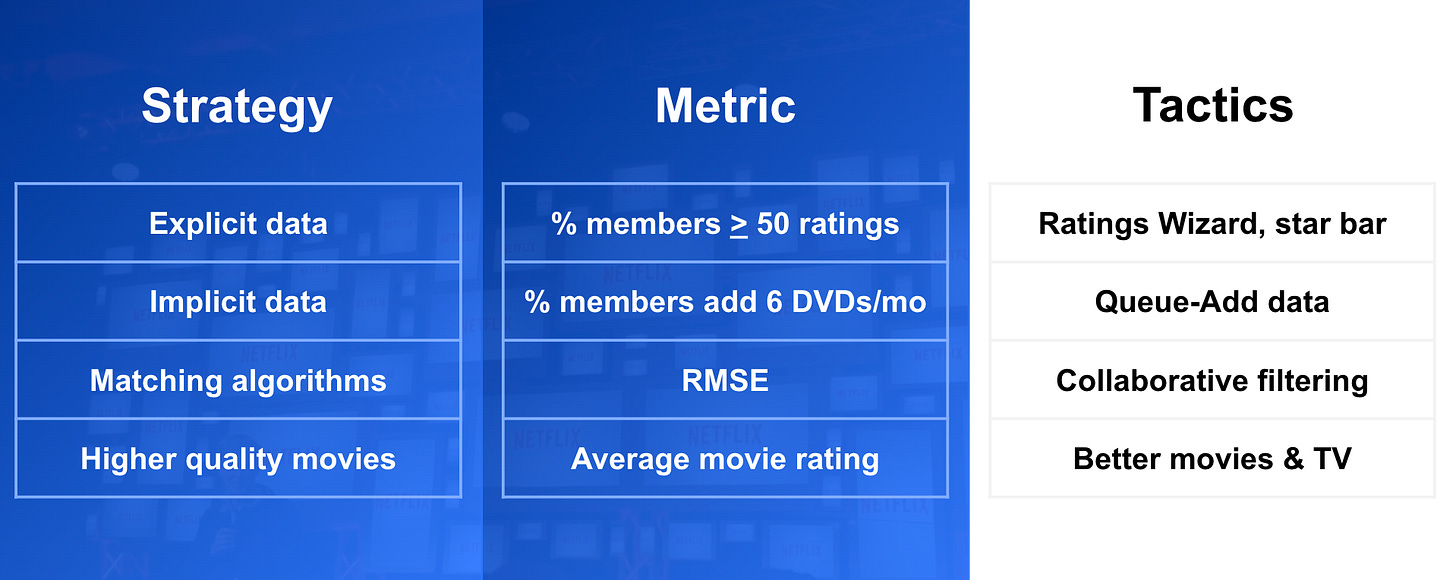

5. THE SMT LOCKUP (essay)

Define proxy metrics for each of your high-level product strategies and tactics or projects for each strategy.

Here’s an example from Netflix circa 2007. Note that each strategy has a metric assigned to it, along with tactics or projects:

Exercise

Outline your strategies, the proxy metric you will use to evaluate progress against each strategy, and the tactics (projects) you will execute to prove or disprove each strategy.

Proxy Metrics (essay)

A proxy metric is a stand-in for a higher-level metric. The intent of personalization at Netflix was to improve retention. Still, because retention is so slow to change, we had a proxy metric — the percentage of customers who rated at least 50 movies in their first two months with the service. The thinking was that members rated movies because they knew that the more they rated, the better Netflix would do at finding movies they’ll love. This was an indirect way to measure how much they valued personalization.

Exercise

Identify your High-Level Engagement metric—the equivalent of monthly retention at Netflix. The challenge of this high-level metric is that it’s tough to improve in the short term, so you need more sensitive proxy metrics to evaluate if you’re moving in the right direction or if your strategies to move your engagement metric are working.

Now, using the Strategy/Metric/Tactic Lockup tool, list your strategies to improve your high-level engagement metric, and then define a proxy metric for each strategy, using the following questions as a guide:

Do the proxy metrics adhere to the following structure? Percentage of (members/new customers/returning customers) who do at least (the minimum threshold for user action) by (X period in time).

Some other helpful direction for proxy metrics:

Is your proxy metric measurable? Can you move it? Do changes in your proxy metric correlate with your engagement metric? In the long term, can you prove causation?

Does your proxy metric measure value creation for your customer?

In the context of an A/B test, can it help you to pick a “winner?”

Generally, avoid averages for proxy metrics as they hide important nuances and variations in the data.

The last step in the SMT model is to assign the projects (tactics) you plan to execute against each strategy.

A Strategy for Each Swimlane (essay)

Exercise: For each swimlane or pod in your organization, articulate your SMT framework. (Typically, the product leader for each pod does this work.) The head of product for an organization creates a top-down product strategy, while product leaders who own their swimlane take a bottoms-up approach. There's iteration to fit both together. Sometimes, the work of an individual product leader informs the overall product strategy. In other cases, the head of the product's strategy work informs the product leaders for each swimlane.

Below, I list an example of an SMT for the Netflix personalization swimlane, circa 2005:

The topline proxy metric for the personalization pod was the “percentage of new members who give at least 50 ratings during their first six weeks with the service.” The team believed that if it could move this metric—a proxy for personalization improvements—they would eventually improve retention. Netflix ultimately proved that personalization improved retention.

6. THE PRODUCT ROADMAP (essay)

Exercise: Outline the projects against each high-level product strategy for each product strategy over the next four quarters. I have included a sample roadmap below from Netflix for the high-level 2005 roadmap— when Netflix was a DVD-by-mail company. Note that the left-hand columns describe the high-level strategy for each swimlane at the time.

FINAL ASSIGNMENT

You’re welcome to do the work I describe above, but my 2 X 2.5-hour product strategy course on Maven allows you to go deeper. I provide many cases and examples from startups, B2B, and enterprise companies. I also offer pre-formulated Google Slides to help you quickly articulate an overall product strategy and a product strategy for each swimlane. Last, we’ll have plenty of time for Q&A. Learn more about the workshop here.

Note: If you’ve made it this far, I would appreciate your feedback on this executive summary. It only takes one minute: Click here.

APPENDIX

There are more resources here:

“How to Run A Quarterly Product Strategy Meeting”

One last thing!

Please complete the “Four Ss” below:

1.) Subscribe to my “Ask Gib” newsletter. (It’s free and always will be!)

2.) Share this essay with others! We’ll collect more questions and upvotes for more relevant articles.

3) “Star” this essay! Click the heart icon near the top or bottom of this essay.

4) Survey it! It only takes one minute to complete this survey. Your feedback improves my free “Ask Gib” product newsletter. Click here to give feedback.

Thanks,

Gib

love the structure!